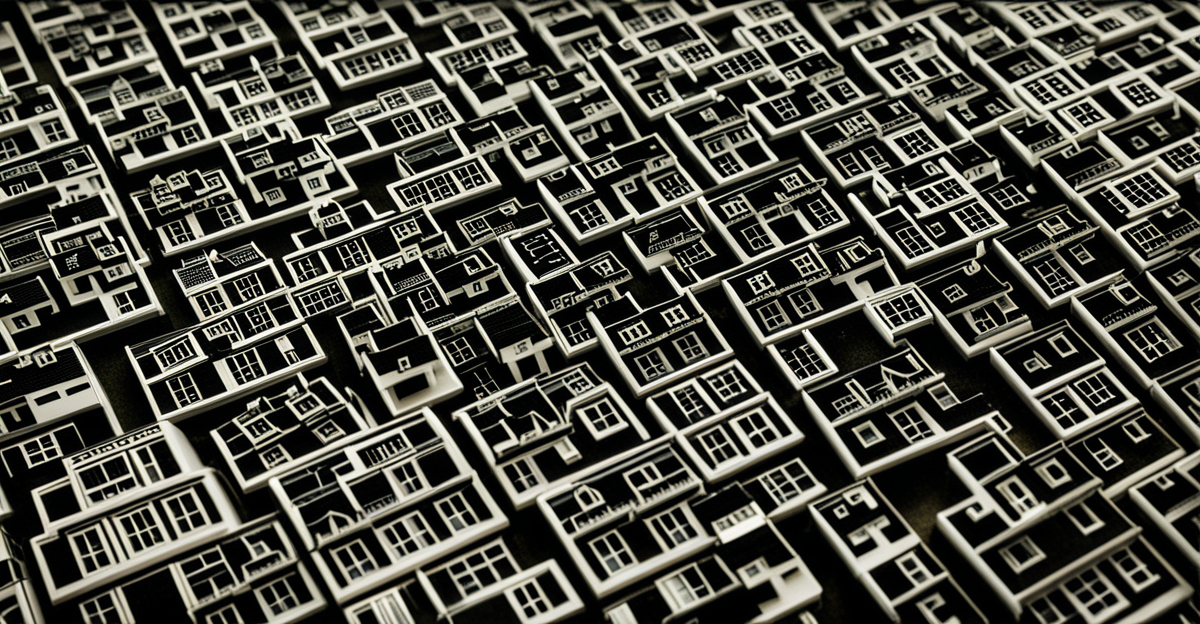

Immediate strategies for navigating financial instability in UK real estate

Navigating financial instability in the UK real estate sector requires targeted, actionable steps amid ongoing market volatility. Understanding current economic challenges is crucial. Rising inflation, Brexit-related uncertainties, and interest rate fluctuations have intensified pressure on property values and rental yields. Investors and property owners should prioritize liquidity to withstand sudden market shifts.

Short-term strategies include conducting a thorough review of portfolios, focusing on properties with strong tenant demand and lower vacancy risks. Selling underperforming assets can free capital to reinforce investments in prime locations, thereby safeguarding property values. Implementing flexible lease terms may also reduce exposure to rent defaults.

Also to read : Understanding the Impact of Brexit on UK Real Estate Investments

Expert analysis suggests maintaining close communication with financial advisors and lenders to renegotiate loan terms or access bridging finance when necessary. Technologies like market analytics tools enable monitoring fluctuations in real time, allowing prompt responses to economic signals.

Risk mitigation through diversification—by geography or property type—is advised even in immediate strategies. This approach helps buffer against localized downturns. Additionally, careful attention to regulatory changes ensures compliance while leveraging new market incentives.

Also read : What are the benefits of buy-to-let properties in the UK?

By employing these practical steps, stakeholders in UK real estate can better manage the immediate impacts of financial instability and position themselves to capitalize on eventual market recovery.

Adaptability through diversification and risk management

Diversification is a cornerstone of resilience in managing property portfolios amid financial instability. Spreading investments across various property types and regions reduces exposure to localized downturns, directly mitigating market volatility risks. By avoiding concentration in a single asset class or geographic area, investors enhance portfolio stability and potential returns.

Implementing robust risk management frameworks involves continuous assessment of market trends and tenant profiles, allowing swift adjustments to changing conditions. Techniques such as stress testing portfolios against economic shocks facilitate preparedness. This proactive stance aligns with expert analysis emphasizing dynamic responses over reactive measures.

Leveraging alternative asset classes within UK real estate—such as commercial, industrial, or mixed-use developments—further supports sustained performance during uncertain times. These sectors often exhibit different sensitivity to economic cycles, providing natural hedges. For example, industrial properties, boosted by e-commerce growth, may outperform residential segments during some downturns.

Establishing clear risk thresholds and liquidity buffers complements diversification efforts. This approach ensures enough capital availability for repositioning or capitalising on emerging opportunities, a critical factor noted in expert assessments. Overall, a diversified and well-managed portfolio forms a resilient foundation, enabling investors to navigate ongoing financial instability with greater confidence.

Immediate strategies for navigating financial instability in UK real estate

Current economic challenges significantly pressure the UK real estate market, driven by persistent financial instability and heightened market volatility. These challenges include rising interest rates, fluctuating demand, and inflationary trends that directly affect property valuations and rental income. Expert analysis highlights the importance of swift, targeted action to mitigate risks in such an unpredictable environment.

To navigate this, property owners and investors should prioritize liquidity by reassessing their cash flow and reducing exposure to volatile assets. Selling underperforming properties allows reinvestment in more stable sectors, securing steady income streams. Additionally, implementing flexible lease agreements can accommodate tenant difficulties, reducing the risk of rent arrears—a crucial safeguard amid economic fluctuations.

Expert analysis also recommends maintaining proactive communication with financial institutions. Refinancing or restructuring existing loans can improve financial flexibility, offering a buffer against sudden shifts in the market. Utilizing advanced analytical tools to monitor real-time market signals enables quicker, data-driven decision-making.

These immediate, actionable strategies are vital for safeguarding property values and maintaining investment stability during periods of significant financial instability in the UK real estate sector.

Immediate strategies for navigating financial instability in UK real estate

Small

The UK real estate sector currently faces pronounced financial instability driven by escalating market volatility and economic pressures such as rising interest rates and inflation. Expert analysis emphasizes the necessity of prompt, targeted actions to guard investments during these turbulent times.

A key strategy involves rigorous evaluation of property portfolios to identify underperforming assets. Disposing of such holdings can enhance liquidity and enable reinvestment in properties with strong tenant demand and resilience. This approach reduces exposure to cyclical downturns and stabilizes income streams.

Implementing flexible lease structures also emerges as a practical method to minimize rent defaults, accommodating tenants facing economic hardship. This flexibility supports tenant retention, a critical factor for sustaining rental incomes during volatile periods.

Alongside these measures, maintaining open dialogue with financial institutions allows for renegotiation of loan terms or access to bridging finance, which can provide much-needed cash flow buffers. Expert analysis further recommends leveraging data-driven market analytics tools to detect early warning signs and adjust strategies swiftly.

Together, these immediate strategies—focusing on liquidity management, tenant relations, and adaptive financing—form a comprehensive response framework for navigating the complexities of financial instability in UK real estate.

Immediate strategies for navigating financial instability in UK real estate

Small

In the face of escalating financial instability and market volatility within the UK real estate sector, immediate, decisive steps are paramount. Current economic challenges include surging interest rates, inflation impacts, and shifts in tenant behaviours that directly threaten property values and rental income. Expert analysis underscores swift adaptation to maintain investment stability.

Short-term strategies start with an exhaustive portfolio review to pinpoint underperforming assets. Selling these properties improves liquidity, allowing reinvestment in areas demonstrating resilience and robust tenant demand. This approach protects assets and mitigates risks from unpredictable markets.

Flexible lease agreements provide another vital tool. By adjusting lease terms to tenant needs, investors reduce rent default risks, preserving regular income. Maintaining open communication with financial institutions is equally important. Renegotiating loan agreements or securing short-term financing can enhance cash flow flexibility.

Utilising advanced market analytics allows stakeholders to monitor real-time economic indicators, facilitating data-driven decisions that pre-empt adverse impacts. These strategies collectively focus on safeguarding property values while enhancing financial resilience, aligning with expert analysis advocating for proactive, informed actions during financial instability in the UK real estate sector.